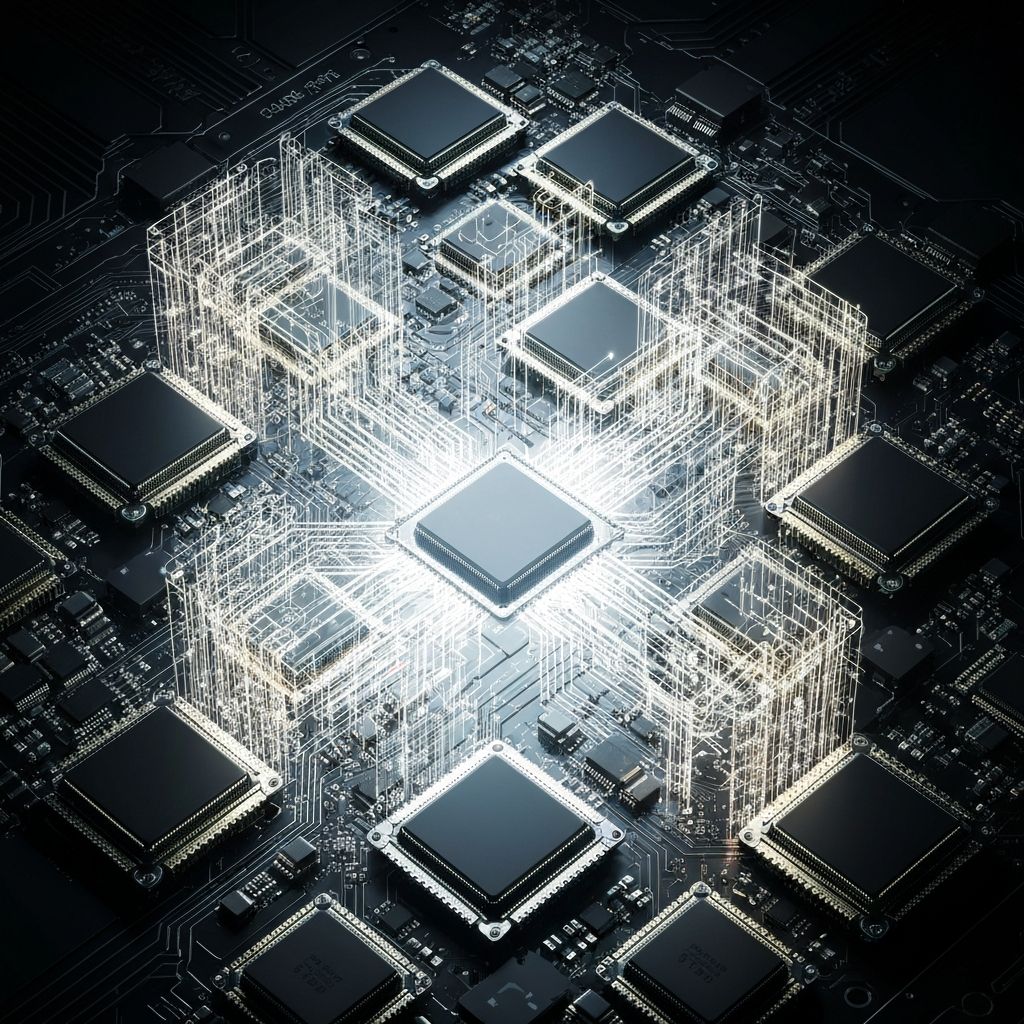

Custom Quantum +FPGA Hardware Platform

Purpose-built hardware combining custom FPGA accelerators with quantum processing units for ultra-low latency financial computations.

Explore HardwareQuantum Tensor Network Processor (QTNP)

A custom-designed quantum processor optimized for financial modeling, integrating cutting-edge quantum processing with classical high-performance computing infrastructure for exponential speedup in complex financial calculations.

<1μs

Quantum search latency

√N

Quantum speedup advantage

>99.5%

Single-qubit gate fidelity

Classical Processing & Control Layer

High-performance classical infrastructure manages data ingestion, preprocessing, and trade execution, while seamlessly interfacing with the quantum core for computationally intensive tasks.

Quantum Tensor Network Processor

Custom quantum processor utilizing 2D grid layout with vendor-agnostic design, supporting superconducting transmon and fluxonium qubits for optimal performance across financial algorithms.

Sliding Window Quantum RAM (qRAM)

Specialized quantum random-access memory for storing and retrieving time-series financial data, enabling efficient quantum queries on large datasets with automatic windowing for real-time updates.

Quantum Pattern Matching Engine

Specialized quantum search architecture based on Grover's algorithm for high-frequency arbitrage detection, providing quadratic speedup for finding complex opportunities in vast search spaces.

Multi-Layer Hardware Stack

Comprehensive hardware architecture abstracting quantum complexity with a programmable interface for financial applications.

Physical & Control

Qubit technology, cryogenic systems, and microwave/RF pulse generation

Gate & Circuit

Single/two-qubit gates, error mitigation, and quantum circuit construction

Algorithm & System

Quantum algorithms (Grover, TEBD) and system resource management

Application

High-level interface for financial applications and use cases

Hardware Design Principles

Core principles guiding the quantum-hybrid architecture for financial computing excellence.

Latency Optimization

Minimizing time from data input to actionable insight for high-frequency trading applications

Scalability

Handling growing number of assets and increasingly complex financial models

Reliability

Error correction and noise mitigation ensuring accuracy of quantum computations

Adaptability

Vendor-agnostic design incorporating new qubit technologies and quantum algorithms

Integration

Seamless connection with existing classical trading infrastructure and data feeds

Modularity

Modular architecture enabling independent upgrades and technology evolution